How to choose the best prepaid debit card for your kids | Kids Prepaid Card | ImageNPay Family

- Naomi Harris

- Oct 16, 2023

- 3 min read

Teaching kids financial responsibility from a young age is key to their development and ensuring they have good money habits as adults. Considering a study by the Money and Pensions Service found that only 47% of children have received a financial education at home or at school, there's a huge gap in financial literacy for the next generation. Teaching our kids money skills at home is an important step to bridging this gap.

One way to do this is by allowing your kids to manage their own money. This teaches them key life skills like budgeting and saving. However, it’s important to pick a debit card that gives your kids financial independence but is kid-friendly. But how do you choose the right debit card for your kids? Here are three things to look for when choosing a debit card for your children.

1) Check the Fees

When picking out a debit card for your kids you should always compare the fee structures of the different debit card providers. Some debit card companies will charge a card issuance fee or a monthly subscription fee for using their payment cards. Compare the different providers and the features they provide to decide what is the best value of money for you.

It’s essential that you check the T&Cs and small print to ensure that you receive no nasty surprise fees. For example, some providers charge you for topping up the payment card. Being aware of the fees upfront can help you make an informed decision about which prepaid card provider to go with, but also how your kids can spend money on the card without acquiring any extra fees.

2) Check the Spending Limits

Kids are still learning to be smart with their money which is why ensuring you pick a kids debit card with spending limits is so important. You want to avoid your kid having to pay interest or overdraft fees if they accidentally spend more than they have on their card.

Choose a kids payment card provider that allows spending controls, whether set by the parent or child, to ensure that there are not any extra fees for overspending on the debit card. One benefit of using a prepaid card is that you can only ever spend what is loaded onto the card which makes it a great option for kids beginning to learn how to budget and spend their money wisely. Find out more about the benefits of prepaid cards here.

3) Check the Security Features

Another key thing to look for when researching kids debit cards is how they keep your child, and their money, protected. It’s important to choose a payment card that has additional security features that will give you peace of mind as a parent.

Whether that’s using a pin code to make payments in-store or two-factor authorisation for online payments to ensure that the correct person is using the card. Features like these can help make it more secure for your kid(s) to pursue financial independence and build important money skills.

By checking the above features when researching debit cards for your kids you can ensure that you pick an option that is right for you and your family.

At ImageNPay we’re committed to making payments more fun, sustainable and secure with our personalisable digital prepaid card app.

Our ImageNPay Family product is specifically designed for parents and children (aged 8-13 years old) to promote financial responsibility and education. ImageNPay+ users can connect up to 3 separate cards to their ImageNPay account for their kids to use.

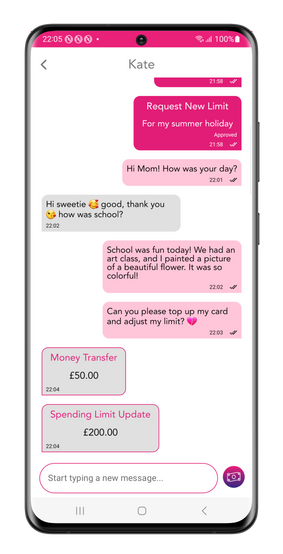

This allows parents to have full oversight over their children’s spending. You can top up your kid's cards, track their transactions and respond to top-up requests within the in-app chat feature. All whilst giving your kids financial independence!

Our ImageNPay Family Cards are designed to make payments more fun and enjoyable for kids, whilst teaching them financial responsibility.

At ImageNPay we only provide digital prepaid cards. By using a prepaid card, your kids are limited to spending only as much as is loaded onto their card. This stops them from overspending and teaches them important budgeting skills. It is also safer and more secure for them to spend their money with a prepaid card as their account details are not linked to a bank account. Learn more about the benefits of using a prepaid card here

Find out more about ImageNPay Family and how you can sign up for an account here.

ImageNPay is FREE to download on iOS and Android.

Comments