What is a Prepaid Debit Card? | Why Should you Use a Prepaid Card? | Prepaid Payment Card

- Naomi Harris

- Sep 4, 2023

- 4 min read

Updated: May 31, 2024

We may be biased BUT we think prepaid cards are the perfect tool to help you manage and budget your finances! In this post, we'll be sharing everything you need to know about prepaid cards and why you should make the switch to prepaid payments.

What is a Prepaid Card?

A prepaid card is similar to other payment cards, except that you pre-load it with money. This means you can only ever spend what you have loaded onto the card. You're only spending your money. You can still use it to pay online and in-store, wherever you usually spend with your payment card.

What are the benefits of using a prepaid card?

Considering you can use your prepaid card like any other payment card, what are the specific benefits of using prepaid to manage your money? Whether you're a budgeting pro, just learning to manage your money or a parent wanting to teach their kids financial confidence and independence - prepaid can work for you!

Better for budgeting

A prepaid card is a great tool to help you budget! As you're pre-loading the card with money, you can't spend more than what's on your card. This helps protect you from going into debt. You can allocate your prepaid card to pay for certain things, like your groceries or monthly social activities, to help your stick within your budget for that category. You're less likely to overspend if you have to make the conscious effort to top-up your card to spend more money.

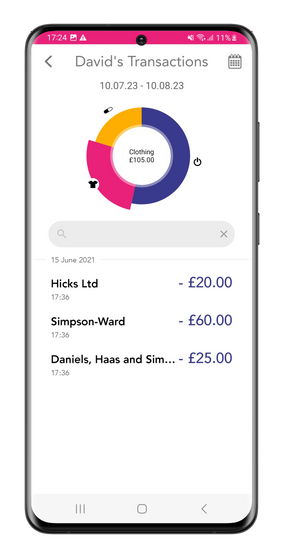

In the ImageNPay app, you can track all of your transactions through the "My Transactions" screen. Your transactions are automatically placed into categories like 'Eating Out' and 'Shopping', so you can clearly see where you're spending the most through our handy pie chart feature. You can also pull out individual categories in the pie chart to view the spending, use keywords to search for transactions or adjust date ranges to create personalised views. Our prepaid card app makes tracking your finances easy!

This feature is available to all ImageNPay users.

Improved payments security

Using a prepaid card is a safer way to pay! As your prepaid card is not connected to your bank account, you can shop online and in-store with peace of mind that your money and details are protected.

At ImageNPay we take this one step further by only issuing 100% digital prepaid cards. This further protects your card details from fraud and ensures you never lose or have your bank card stolen again! We also have extra features in-app to protect your prepaid card:

Pin code-protected app

Freeze your card easily in-app if you believe your card details to have been compromised

Request a new card if your current card is no longer safe to use

Keep your contact details up-to-date in-app to be alerted to any suspicious activity

These features are available to all ImageNPay users.

No interest fees

The great thing about using a prepaid card is that there are no nasty credit or overdraft fees! As you're spending your own money there's less chance of going into debt or spending more than you have. This helps protect your credit score and brings you peace of mind when shopping. And with our handy in-app budget breakdown feature you can be sure that you're being smart with your finances!

The ImageNPay app costs only £1.99 a month and has zero loading fees up to £200 a month.

Teaches financial confidence

If you're a parent wanting to teach your kids money skills, or an adult new to managing your money, then a prepaid card is a great tool to teach financial confidence and independence. You can use a prepaid card to build confidence with budgeting and tracking your finances, whilst being protected from credit and interest fees!

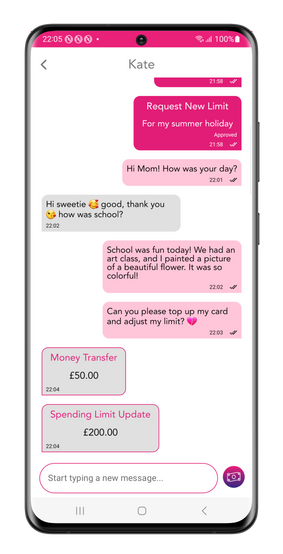

Our ImageNPay Family product is designed with parents and kids in mind. ImageNPay+ users can connect up to 3 additional prepaid cards to their account for their kids (aged 8-18) to use. With ImageNPay Family you can view your kid's transactions, set monthly spending limits on your kid's cards, top-up their card in-app, answer top-up requests through our in-app chat feature and more! All whilst your kids build their understanding of managing money. Find out more about ImageNPay Family and how to sign up here.

ImageNPay Family costs only £1.99 a month and a one-off charge of £1 per additional card.

Using a prepaid card has benefits for adults and families alike! With budgeting capabilities, enhanced security and reduced fees a prepaid card is the ideal tool for spending and managing your money. You can read more about the benefits of prepaid here.

Want to try prepaid payments for yourself?

ImageNPay is a personalisable digital prepaid card app available on both iOS and Android.

Our app is FREE to download and explore with our Try Before You Buy feature. Once you have activated your prepaid card our app costs only £1.99 a month, regardless of what ImageNPay product you use!

Download ImageNPay: